Nigeria's Excess Crude Account (ECA) is an often discussed but poorly understood aspect of the country's fiscal policy landscape. Established in 2004, it was conceived as a financial cushion to save surplus revenues from crude oil salesan attempt to buffer the economy from the sharp fluctuations of global oil prices.

As we navigate through 2024, the ECA has faced significant challenges, including mismanagement, low savings, and political pressures. Understanding the ECA's ups and downs offers valuable insight into Nigeria's economic strategies and the role of oil in its development (or lack thereof).

What is the Excess Crude Account (ECA)?

The ECA was initially envisioned as a savings mechanism designed to store any revenue from crude oil sales that exceeded the budgeted benchmark price. For example, if Nigeria planned its budget assuming crude oil would sell at $40 per barrel, but it actually sold for $50, the extra $10 per barrel would go into the ECA. This reserve fund could then be used to plug budget deficits during times when oil prices fell below expected levels.

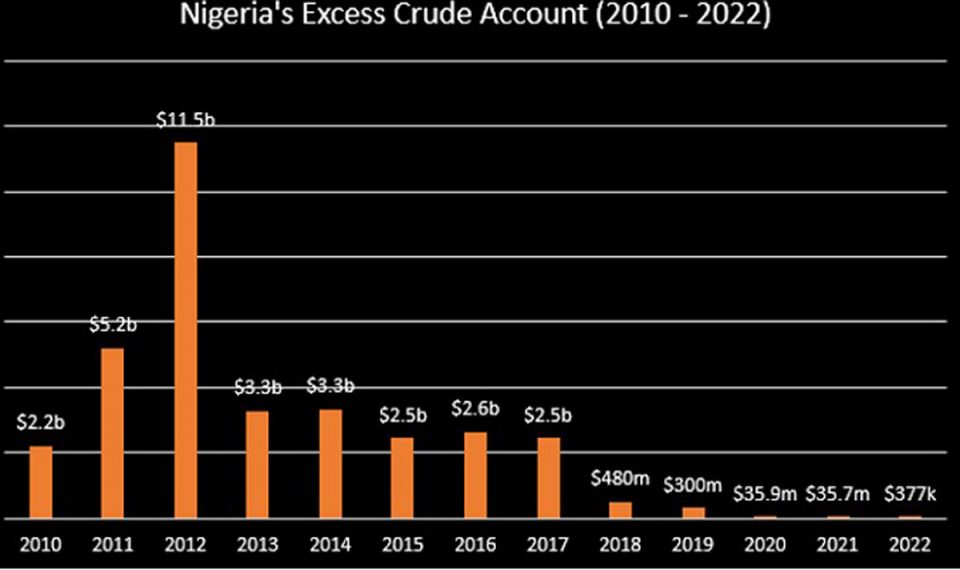

However, in practice, the ECA has often been subject to differing interpretations by the federal government, state, and local governments, resulting in its frequent depletion. From a peak of $20 billion during the early years of its establishment, the ECA today holds only a few hundred thousand dollars$473,754.57 as of March 2024, a significant decline from the billions it once held.

History and Evolution of the ECA

The ECA was established during President Olusegun Obasanjo's administration in 2004 to serve as a fiscal buffer and stabilizer for the Nigerian economy. The idea was simple: save when times are good and spend when times are bad. From 2005 to 2009, the ECA amassed a healthy $20 billion, which accounted for a large chunk of Nigeria's external reserves at the time. The account was intended to shield the economy from the volatility of oil prices that are subject to global market dynamics.

Unfortunately, this promising start took a downturn during subsequent administrations. Mismanagement, coupled with an absence of strong legal backing, made it easy for funds to be accessed for all sorts of fiscal shortfalls rather than for the intended purpose of stabilizing the budget. The depletion became more drastic under President Goodluck Jonathan and further declined during President Muhammadu Buhari's tenure, leaving the account nearly empty by 2024.

Why Has the ECA Been Depleted?

The depletion of the ECA can be attributed to a number of key factors:

Mismanagement and Lack of Legal Backing: The ECA needs more constitutional protection, allowing successive governments to access it easily without proper oversight. This has turned the ECA into a tool for short-term funding rather than a long-term economic buffer.

Frequent Withdrawals for Political Reasons: Governors often pressured the federal government to disburse ECA funds, particularly during election periods, weakening the accounts savings potential.

Lower Oil Revenues: Declines in crude oil earnings, exacerbated by production issues, theft, and underinvestment, have led to fewer contributions to the ECA.

Economic Vulnerability: The depleted ECA leaves Nigeria highly exposed to oil price shocks, with minimal fiscal reserves to mitigate potential economic downturns.

The Current State of the ECA (2024)

As of early 2024, Nigeria's ECA balance stands at $473,754.57a paltry sum considering the size of the Nigerian economy. This depletion is alarming, given the country's growing economic challenges. The ECA's low balance has prompted renewed calls for fiscal discipline and better management of Nigeria's oil revenue.

The Federal Government, under President Bola Ahmed Tinubu, has also implemented some programs to try to stabilize the economy, including targeted payments to vulnerable citizens. However, these efforts come alongside an overall sense of financial fragility, as the country lacks a substantial reserve to weather potential oil market downturns.

The Economic and Social Impact

The depletion of the Excess Crude Account (ECA) in Nigeria has profound economic and social ramifications. As a crucial fiscal buffer, the ECA is designed to provide financial stability during times of economic uncertainty, particularly in an oil-dependent economy like Nigeria's. With the account depleted, the government faces heightened pressures, forcing it into increased borrowing or necessitating cuts in vital public spending. This has far-reaching consequences for critical sectors, including infrastructure development, healthcare, education, and emergency response services.

In an economy where a significant portion of revenue comes from oil exports, the absence of the ECA exacerbates Nigeria's vulnerability to global oil price volatility. When oil prices drop, as they have in recent years, the government loses a substantial portion of its revenue, leading to budget shortfalls. The World Bank has cautioned that a moderate decline in oil prices could propel Nigeria into a recession, given the absence of financial safeguards like the ECA. This risk is compounded by the countrys reliance on oil, which makes it susceptible to external market shocks.

Socially, the repercussions are equally severe. Reduced government spending can lead to deteriorating infrastructure, insufficient healthcare services, and inadequate educational resources. This, in turn, negatively impacts the quality of life for ordinary Nigerians, particularly in the poorest regions. Increased borrowing to cover budget deficits can result in higher debt servicing costs, diverting funds away from essential services.

Ultimately, the depletion of the ECA not only threatens Nigeria's economic stability but also undermines its social fabric, making it imperative for policymakers to explore strategies for replenishing this vital fund and revenues.

Conclusion

The Excess Crude Account, meant to stabilize Nigeria's economy, has largely failed due to mismanagement, political pressures, and lack of transparency. Its depletion highlights deeper issues within Nigeria's fiscal policy, including over-reliance on oil revenue.

To rebuild economic stability, Nigeria must strengthen the governance of its oil funds, seek constitutional backing for fiscal reserves, and diversify its revenue streams beyond oil. The ECA's current state serves as a stark reminder of the need for prudent financial planning and responsible resource management to ensure a more sustainable and resilient economy for the future.