First time or a long time since you've filled out a check. You may have concerns about check writing, such as where to sign the check and how to write a check and include cents. If you need a quick tutorial, have a look at ours. Place the current date in the upper right corner. This must be done so that the recipient and the bank can verify the exact time the check was written.

An arrow pointing to the date on a personal cheque. The second step is to identify the recipient of the financial aid.

After "Pay to the order of," write the name of the person or business you're writing the check. If you do not know the correct spelling of the name, you can write "cash" instead. However, you could be in jeopardy if the check is ever lost or stolen. Checks written to "cash" can be deposited or cashed by anyone. The personal check's arrow indicates to whom the funds should be paid.

Express the Money Owed As Words

Enter the exact dollar amount that you entered in the box below "Pay to the order of" in words. Write "one hundred thirty and 45/100" if the total due is $130.45. Put the cents amount over 100 if you want to write a check for that amount. To avoid confusion, write "and 00/100" even if the dollar amount is a whole number. When processing a check, the dollar amount must be written out in words so that the bank knows it is receiving the correct payment. The dollar amount is written in words on the bottom of a personal check with an arrow pointing to it.

Draught a Memorandum

If you want to keep track of how to write a check with cents , it's not required that you fill out the "Memo" section. Write "Electric Bill" or "Monthly Rent" in the memo section of your check if you are paying a monthly electric bill or rent. It's common practice for businesses to request that you include your account number in the memo section of your check when making a payment. A blank check with an arrow indicating the memo section

Use your signature when opening the checking account to sign your name on the line at the bottom right. This verifies to the bank that you are paying the correct payee for the stated amount—a signature-pointing arrow on a blank personal check. Create a checking account at Huntington. We have the right options for you, whether you're looking for a free, no-frills checking account or one that pays interest on your balances.

Balancing Techniques

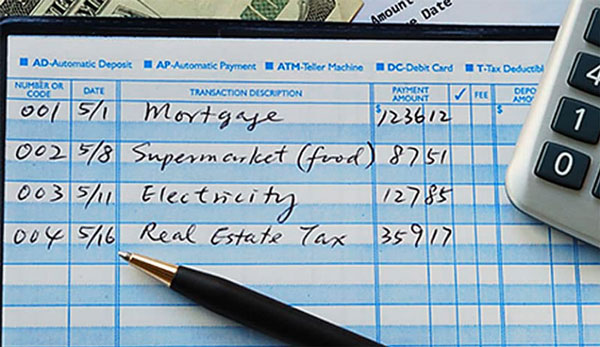

If you want to keep track of your purchases and deposits, use the checkbook register with your Huntington checks. Record your deposits and expenditures in your check register. Checks, ATM withdrawals, debit card payments, and deposits should all be logged.

Keeping Track Of Your Spending

How to write out a check When writing a check, write down the check number in the upper right-hand corner. All of your checks will be accounted for, and you'll be reminded to reorder more when you use this inventory management method. Remember to write down the date, so you'll remember when it happened. Explain where and for what the transaction was made in the "Transaction" or "Description" column. Then, record the amount in the withdrawal or deposit column, depending on whether the money was spent or received.

It's important to check your monthly bank statement for discrepancies. Be sure to balance your checking account every month after receiving your bank statement either in the mail or online. Get started right away by saving our balance sheet. Then, after reading the instructions, you'll input your bank account statement, checkbook register, and any unrecorded deposits or outstanding checks or withdrawals.

If, after adjusting your checks and your account balance, they both equal zero, your checking account is balanced. If there are discrepancies, you should double-check your calculations, check for any outstanding checks that still need to clear and look for any fees or transactions that might not have shown up on your statement. Get in touch with Huntington immediately if you notice an error on your bank statement.

With the advent of online banking, mobile banking, and budgeting technology, balancing your checkbook may seem like a thing of the past. Even if you have access to your account balance and spending history regularly through, say, Online Banking, there are advantages to balancing your checkbook at the end of each month (or even each week