Accounts payable refers to financial transactions that record the amount of money payable to suppliers for products and services. It may also be used to describe the actual bill or invoice that is sent out for payment. Businesses can improve their financial and debt management by better understanding accounts payable and how they operate. It is crucial to monitor your AP expenses and enforce internal controls to safeguard your funds and assets and prevent paying for fake invoices. In this article, we will define accounts payable, give some examples, and look at why it's a crucial component of every company's accounting system in this blog post.

What is Accounts Payable (AP)?

On a company's balance sheet, accounts payable (AP) refers to the amounts owed to suppliers and vendors to whom the business provided credit for purchasing products or services but has not yet paid to the provider. Your company's accounts payable is the total of all remaining payments that have not yet been paid to vendors.

A business account and the department that deals with invoices are called accounts payable (AP). AP is a type of accrual accounting in which a particular general ledger account is represented. This liability account represents a business's responsibility to settle short-term debts with vendors, suppliers, or creditors. These transactions' complete accounting entries can be found on a balance sheet under current liabilities.

What does Accounts Payable Do?

The accounts payable department provides clerical, administrative, and financial support to a company. This group is in charge of overseeing the entire accounts payable procedure, which includes coding, approval, payment, and reconciliation of supplier invoices. It is an essential part of the business's accounting department.

Every task the accounts payable team performs contributes to streamlining the payment procedure and guaranteeing that payments are only made on accurate and valid bills and invoices. Your company can save significant time and money on the accounts payable process by having a competent and efficient department. AP teams may quickly determine when to pay invoices to prevent late fees or take advantage of early pay savings as they are equipped with automation tools.

How to Record Accounts Payable?

Every entry in bookkeeping and accounts payable needs to have an equal number of debits and credits. When an invoice or bill is received, the accountant initially credits the accounts payable account. After that, the expense account representing the products or services purchased on credit is usually the beneficiary of the debit offset for this item. Alternatively, if the acquisition involves a fixed asset, the debit could be assigned to an asset account.

After bill payment, the team debits the AP account to reduce the liabilities balance. This debit is matched with a credit to the cash account, lowering the cash balance. This thorough documentation in accounts payable guarantees adherence to accounting guidelines and offers clarity and precision in a company's financial records. It also helps stakeholders make smart choices and is crucial in maintaining strong financial management procedures.

Understanding Accounts Payable Process

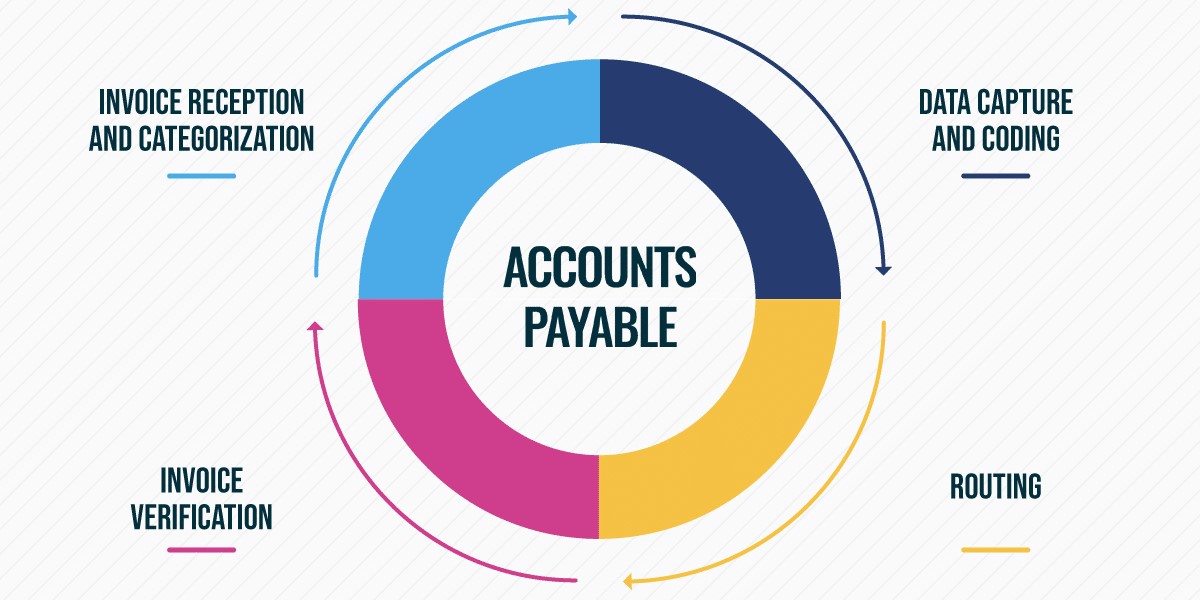

A company's financial responsibilities to its suppliers and creditors are managed through the accounts payable procedure. There are four main steps in the accounts payable process from beginning to end:

Receiving invoices

Invoice capture generally involves manually typing invoice data, including supplier information, line items, amounts, and GL code, into a record-keeping system. It presents both human error and accuracy hazards.

Approval of invoice

The process of reviewing and approving supplier invoices is known as invoice approval. An AP team member walks the paper invoice around the office to get the required approvals. This takes place before the cost is entered into the ERP and money is sent.

Payment Authorization

Before you can pay an invoice that is ready for payment, you need permission. The invoice should include the sum, the method, and the date that you will be submitting the payment.

Payment transfer

The invoice is paid, and the vendor receives the remittance details after receiving payment permission. It typically involves printing, signing, and mailing checks, starting an automatic transfer from the bank, or making credit card payments. The invoice can now be filed into different repositories and closed out of the system.

Accounts Payable Examples

The money you owe suppliers, borrowers, and vendors for services and products is accounts payable. Your balance sheet shows accounts payable as a liability rather than an asset like cash. A few examples of AP are:

- Cash to be paid to suppliers for goods purchased

- Debt owed to credit card firms

- Amounts due to utility providers

- Salary and wages due to workers

- Rent to be paid to landlords

- Taxes payable to the state

- Loan interest payments that are due

Accounts Payable vs. Receivable

In simple terms, accounts payable and accounts receivable (AR) are the opposites. The money a business owes its vendors is known as accounts payable, and the money customers owe the business is known as accounts receivable. When two businesses deal on credit, one will record an item in its books for accounts payable and the other for accounts receivable.

Accounts Payable vs. Trade Payables

Although these names are synonymous, they are slightly different. The money you owe your vendors for costs associated with inventory, such as office supplies or inventory materials, is known as trade accounts payable or trade payables. Accounts payable include trade payables, and several businesses merge the two into a single account payment procedure.

Conclusion

Accounts payable (AP) and cash management experts are valuable assets to any firm, helping to ensure financial stability at all stages. A company's ability to remain healthy significantly depends on accounts payable. It's a financial procedure that includes receiving invoices, checking them, paying them, and keeping track of the information. However, an unstructured AP department encounters numerous obstacles. When vendors are not paid, relationships decline, the supply chain is slowed down, and discounts are lost.